Table of contents:

- The program for increasing pension payments to various categories of pensioners

- Change in the funded part of the pension in 2021

- Increase in other payments

- Cost of living in 2021

Video: Indexation of pensions for non-working pensioners in 2021

2024 Author: James Gerald | [email protected]. Last modified: 2023-12-17 14:00

The increase in the size of pensions is a compensatory mechanism within the framework of the pension reform in Russia. V. V. Putin's decree of May 3, 2018 No. 204 provides for an annual increase in payments by a percentage higher than the inflation rate. In accordance with the Presidential Decree, the State Duma adopted Federal Law No. 350 dated October 3, 2018, which at the legal level introduces a change in the procedure for calculating payments. The program covers the period up to and including 2024. Find out what the indexation of pensions for non-working pensioners will be in 2021.

The program for increasing pension payments to various categories of pensioners

In order to understand how much pensions will increase, you need to know the amount of the fixed payment (FW) or the additional payment established in the current year. This is the part of pensions that is added to the accruals for the insurance period, an analogue of the previously existing basic payment.

Depending on the accrual of regional additional coefficients to the FV, the indicators differ by region. FV is automatically accrued by the Pension Fund of Russia (Pension Fund of Russia) to each person who is eligible for an old-age pension.

Categories of citizens receiving increased fixed payments

Certain categories can count on increased payment fixing. They fall into the following categories:

- Elderly people over eighty years of age.

- Citizens with disabilities (group I).

- People of retirement age with dependents.

- Those who worked in the North, if they have 15 years of insurance experience.

- People who have been employed in agriculture for more than 30 years have lived or worked in rural areas. Obligatory contributions to the FSS. Fixed payment surcharge + 25%.

- Federal Law No. 400 of December 28, 2013 determines additional charges for those who have received the status of "Veteran of Labor" (more than 40 years of experience).

An additional coefficient for the length of service received before the collapse of the USSR, the so-called Soviet length of service, is charged if a citizen of the Russian Federation had at least 1 working day in the work book before 2002, and the pension was accrued:

- at the onset of the required age;

- if you have a disability;

- loss of the breadwinner.

If a citizen of the Russian Federation applied for a pension later than the deadline when he is entitled to payments by age, then a multiplying coefficient is charged.

Let's say a person applied in 2021, 5 years after overcoming the age retirement threshold. The increase coefficient will be 1, 36, and the amount of PV - 6044, 48 rubles. It needs to be multiplied by a factor of 1, 36.

6044, 48 × 1, 36 = 8220, 49 rubles.

The second indicator is the pension score, or IPK (individual pension coefficient), is determined by the employer's contributions to the insurance fund, contributions from the maximum salary for the year. The maximum number of points is legally limited. The amount of FV, accruals per point (IPC) is growing every year:

|

Year |

FV amount in rubles | Amount in rubles for 1 point or IPC | Increase, in% |

| 2018 | 4982, 9 | 84, 49 | |

| 2019 | 5334, 19 | 87, 24 | 7, 06 |

| 2020 | 5686, 25 | 93, 00 | 6, 6 |

| 2021 | 6044, 48 | 98, 86 | 6, 3 |

| 2022 | 6401, 1 | 104, 69 | 5, 9 |

| 2023 | 6759, 56 | 110, 55 | 5, 6 |

| 2024 | 7131, 34 | 116, 63 | 5, 5 |

As can be seen from the table, the indexation of pensions for non-working pensioners in 2021, based on the latest news, will be 6.3%. It is planned to increase the average pension in the country to the level of 17,432 rubles (in 2020 - 15,000 rubles).

Change in the funded part of the pension in 2021

As you know, the employer can transfer part of the insurance contributions (22% per employee) to his individual savings account. Based on the calculation: the insurance premium is 22%, 16% - to the insurance fund, 6% - to the individual savings account, at the request of the employee.

The latest news from the State Duma on the indexation of the funded part of pensions for non-working pensioners in 2021 will not please. First, it will not be adjusted upward. Secondly, in order to start paying the funded part in 2021, it is necessary to make monthly contributions of 6% for the previous 22 years (or 264 months), in 2020 - 270 months.

The payment for the funded part is calculated as follows: the amount on the individual current account is divided by 264 months. This part of the pension savings in Russia can be obtained as follows:

- the whole amount at once;

- as an addition to the insurance pension, in equal shares together or as a separate payment;

- in a time convenient for the pensioner.

To get it, you need to write an application, submit it to the FIU. Within 10 days, it must be considered, no more than two months later, the payment is made.

There is an opportunity to "buy" points or PKI by paying the insurance premium directly to the FIU.

Increase in other payments

The latest news from the Pension Fund of the Russian Federation: with the indexation of pensions to non-working pensioners in 2021, additional payments will increase. From the beginning of January, payments for insurance pensions will increase: for old age, disability, loss of a breadwinner. Social payments will be raised by the percentage of inflation (approximately by 3.8% from February 1).

Provided that inflation may be higher, the indexation will be revised. In early April, state and social payments will be indexed by 2.6%. The former military will raise pensions from October 1 to 3, 7%.

Other payments will increase by 3.8%:

- EDV (monthly cash payments);

- NSO (set of social services);

- social payments from the pension fund;

- payment for burial.

The sizes are approved by the Federal Laws. The final increase in payments depends on the regional cost of living, local allowances.

Interesting! Contractor salary in 2021 in Russia

Cost of living in 2021

PM (subsistence minimum) is a defining indicator for pensioners. In the event that a person does not have enough insurance experience, his pension does not reach the subsistence level, social benefits from the regional fund will be added to him to the level of 86% of the subsistence minimum.

The form of calculating the PM has also changed. Previously, it was calculated based on the consumer basket in a particular region. Now they will be calculated on the basis of average per capita income.

Based on the chart showing the national average income, the middle point will be taken as a starting point. This will be the indicator of the subsistence minimum in the country (“median of average income” - MSD). The minimum subsistence allowance will be 44.2% of the MDC + social regional additional payments.

Outcomes

Fresh news from the State Duma indicates that state legislatures are trying to improve the mechanism for indexing payments as part of the Pension reform. Crisis phenomena in the economy, coronavirus limit the material possibilities of the budget. Even in these critical conditions, the state is trying to protect and support the vulnerable category of people - pensioners.

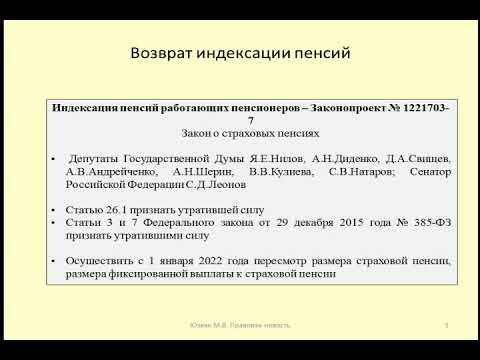

In the fall, the President, in his message to the Federal Assembly, called for the protection of the rights of not only unemployed pensioners, but also those who continue to work. The previously imposed moratorium (from 2015 to 2021) on the indexation of working pensioners will expire soon. The question of indexing this category of citizens is under discussion in the State Duma. It is difficult to say when this issue will be clarified. We need to find an additional 370 billion rubles in the budget.

Recommended:

Payment of 10 thousand rubles to pensioners in 2021

What are the terms and dates of payment of 10,000 rubles to pensioners in 2021? Who is entitled to payments and what is their amount. How can I arrange and receive

Social benefits for pensioners in Moscow in 2021

Social benefits for pensioners in Moscow: which are due in 2021

Benefits for pensioners in the Moscow region in 2021

Benefits to all pensioners of the Moscow region in 2021. Different types of privileges

Will there be an indexation of pensions after dismissal in 2020

Will the pensioner's pension be indexed when he finishes working in 2020. How will the pension change after the pensioner terminates the employment contract

Indexation of benefits for labor veterans in 2021

Benefits for labor veterans: types, size. Will there be an increase in payments in 2021 and by what amount