Table of contents:

- The outlook for the ruble

- What happened in the last days

- Default or devaluation

- How to keep your savings

- Summarize

Video: The collapse of the ruble in 2020 and expert forecasts

2024 Author: James Gerald | [email protected]. Last modified: 2023-12-17 14:00

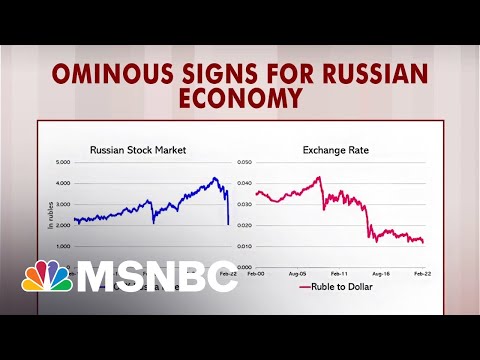

The latest news with constant constancy discusses the impending collapse of the Russian economy, the collapse of the ruble and other pessimistic forecasts of experts. In 2020, after the relative stability of the Russian national currency, the value of the dollar rose again.

The outlook for the ruble

Rossiyskaya Gazeta has published another expert forecast. A. Pokatovich, chief analyst at BCS Premier, expressed his authoritative opinion on the impending collapse of the ruble, predicting its further fall in April.

According to the analyst, even against the background of the cessation of the coronavirus epidemic and the recovery of the world economy, there is a probability (38%) that the national monetary unit of Russia will decrease to figures that are below 85 rubles per dollar.

Due to the external unpredictability of events in the world economy and the planetary pandemic, the opinions and forecasts of experts do not differ in a special set of options, the weight of the arguments and the accuracy of the analysis. The entire verbosity array can be easily sorted into three roughly equal parts:

- gloomy and pessimistic, imaginative and picturesque - for example, “three black swans of the Russian economy”, “the global crisis has taken Russia by the throat”, “default in the country is inevitable, Russia is heading to get hit”;

- restrained-moderate, recently tolerantly called realistic - there are many prerequisites that presumably will affect the ruble, it is impossible to take everything into account, it is not known how the situation will turn out;

- optimistic, sober looking at things, knowing that the ruble is relatively stable compared to many world currencies, and the dollar is increasingly entering the zone of instability due to external risk and the government's habit of turning on the printing press for any reason.

This year there have been events that were impossible to predict, from the point of view of the layman. For example, when in 2019 it was said that the collapse of the ruble in 2020 would occur subject to a fall in oil prices and a weakening of China, the first horror story was always used in the forecasts of financial experts, and the second seemed unlikely.

Even in early March, when the latest news reported on the stock market panic, the most seasoned analysts lost sight of several important factors.

What happened in the last days

In March 2020, several important events took place that were not taken into account in the very one-sided forecasts of experts. After the weekend in March, N. Orlova, an economist at Alfa-Bank, expressed the categorical opinion that the collapse of the ruble is an inevitable consequence of Russia's disruption of the oil deal and the global pandemic, which has just begun to gain momentum.

The three pillars on which each gloomy forecast about the collapse of the ruble was based - a weak China that does not buy oil, the fall in fuel prices due to lack of demand and the spread of the pandemic, turned out to be unexpected for Russia. They may have played a role in preventing the ruble from further falling against the dollar:

- Iran is on the list of leaders in the anti-rating for the incidence of coronavirus. The unfavorable epidemiological situation forced him to declare a decrease in oil production. This has led to a growing demand for the Russian product from those countries that do not buy shale oil.

- China did not weaken, but defeated the epidemic and bought a large batch of oil from Russia for work on economic recovery. There is no doubt that trade wars between the United States and China will soon begin again, especially given the accusations made against America.

- The states came out on top in terms of the number of people infected with coronavirus. Their number exceeded the Chinese figures. Against the backdrop of a total disaster, it turned out that a country with a powerful economy and developed medicine in some states cannot cope with the epidemic.

Whether the forecasts of experts could have predicted such the latest news, expressing gloomy prophecies about the impending financial catastrophe, is extremely doubtful. How many more unexpected turns awaits the global global system in 2020, financial analysts hardly know.

Default or devaluation

Experts give the minimum, almost zero probability of default in Russia. Usually it is announced if the debtor is unable to settle accounts with his creditors. The Russian Federation has no external debts. And even if they did, it has a prudently formed gold reserve and a fund with several trillions accumulated just in case.

The latest news about the adoption of amendments to the Constitution outwardly has nothing to do with this, although in fact they provide for the withdrawal of Russia from external control. Succession of the USSR - and this means new rights to membership, funds, prerogatives.

Devaluation (depreciation of money), hidden, caused by higher prices for food and medicine, is inevitable. But it is happening not only in Russia.

If the Russian Federation was in some kind of abstract vacuum, it would not be affected by the processes in the world. But during a pandemic, even the absence of reciprocal payments between countries affects all currencies.

Optimists are confident that the ruble will relatively stabilize in late May - early June, and by the end of the year it may reach the level of 2019.

How to keep your savings

The latest news in March is full of speculations about the advisability of buying currency in 2020 against the backdrop of the current collapse of the ruble, or maybe it is better to turn to the euro as the preferred option. Analysts are confident that such a deal will be extremely unprofitable for an ordinary citizen, but it will play into the hands of someone who fancies panic and withdraws their profits from it.

As an argument, the latest news about dollar quotes is given:

- On March 20, the cost of one dollar was calculated in the region of 80 rubles, and alarmists rushed to buy American currency;

- after 4 days, the value of the dollar was already 78 rubles, and, despite the small difference, the owners of the large ruble mass lost quite a lot when buying, letting someone earn money;

- according to analysts, people drive themselves into a loss, giving rise to an increased demand for the purchase of foreign currency, and, as a natural consequence, there is an offer at a higher price.

Any collapse of the ruble, according to financial analysts, is not terrible for those who invest in bonds, real estate, antiques, shares of proven enterprises. The need to keep funds for certain purposes does not mean that rubles must be changed without fail for dollars or euros.

Bank deposits, albeit at low interest rates, will protect funds from devaluation and will not create losses in the time spent looking for exchange options. And they will also save you from losses that are inevitable in any case due to the difference in the price of buying and selling.

Summarize

- There are no serious reasons to assume that the ruble will collapse.

- The epidemic ended in China, he bought Russian oil.

- In the States, the infection has spread en masse.

- There are savings in Russia and no external debt.

- All world currencies are also "suffering" from the coronavirus epidemic.

Recommended:

What will be the dollar exchange rate in October 2021 and expert opinion

Dollar exchange rate forecast for fall 2021. What will the dollar exchange rate be in October 2021, whether it will rise or fall. Factors affecting the change in the exchange rate of the dollar against the ruble. Reasons for currency fluctuations

What will be the dollar exchange rate in November 2021 and expert opinions

Prospects for changes in the value of the dollar. What will be the dollar exchange rate in November 2021. Analytical forecast and expert opinions. Dynamics of the dollar in the table

When will the coronavirus end in the world and expert predictions

When will the coronavirus in the world end, what do experts say? How things are in Russia and around the world, in what year to expect the end of the epidemic, expert forecasts

Dollar in 2022: expert forecasts

Dollar exchange rate in 2022: analysts' opinions, preliminary forecast. What can affect the change in exchange rates in the near future and in the future

The expert said that Kate Middleton and Meghan Markle need to enter into an alliance

The columnist analyzed the relationship in the royal family and came to the conclusion that it is necessary to conclude an alliance between Kate Middleton and Meghan Markle